GCC investments in Pakistan’s soil could turn around region’s economic fortunes

The news has been buzzing all month long. It’s been no secret that Pakistan has vast mineral deposits which can, if properly developed, change its economic fortunes. Now, the potential for GCC investments in this sector add a fresh dimension to already friendly ties and will be mutually beneficial. Late last month, a much-awaited mineral summit was held in Islamabad to highlight the significance of Pakistan’s mineral wealth and attract foreign investments to utilize its potential fully. Then Prime Minister Shehbaz Sharif was the chief guest while those present included Army Chief General Syed Asim Munir and the Kingdom’s Vice Minister for Mining, Khalid Bin Saleh Al Mudaifer. The summit was sponsored by the Ministry of Petroleum, the newly created Special Investment Facilitation Council (SIFC) and Barrick Gold Corporation of Canada. From “dust to development” was the aptly called summit motto.

Pakistan’s mineral deposits are worth $6 trillion, by current estimates. These include precious stones and lithium in the northern areas, coal and natural gas in Sindh, gold, silver, copper and chromite deposits at two sites in Balochistan, marble and natural gas in Khyber Pakhtunkhawa (KP) province and the world’s second largest rock salt mine in Punjab province. Apart from being used for edible purposes, rock salt has numerous industrial uses as well. Coal deposits in Sindh are huge but their chloric value is medium. However, the coal being extracted in Balochistan is of good quality. Full and prudent exploitation of these resources could truly transform economic fortunes in Pakistan and be equally beneficial to foreign investors.

The GCC countries have made good use of their hydro-carbon wealth and developed allied industries like plastics, building materials, metallic alloys, polymers and lubricants. They are now in a position to share their mining knowledge and skills with Pakistan and other countries. The skills and know-how developed at institutions like the University of Petroleum and Minerals (UPM) in Dhahran can guide Pakistan in developing similar institutions. Saudi Aramco and Saudi Arabian Basic Industries Corporation (SABIC) are two success stories and many Pakistani engineers have gained useful experience there. The Kingdom’s Maaden and Manara Minerals companies’ representatives also attended the Islamabad summit.

GCC countries have invested in corporate mechanized farming in Pakistan, which will go a long way in enhancing regional food security.

Javed Hafeez

The two companies have vast experience in the mining of phosphates and manufacturing aluminium, copper and nickel. Saudi Vice Minister described the summit as the beginning of a new era in Pakistan. Indeed the perennial problem of balance of payments faced by Pakistan can be offset by exporting mineral products. That way Pakistan will not only earn much needed foreign exchange but also reduce its dependence on textiles through diversification. International interest in Pakistan’s mining sector has begun to grow. A Chinese company is already extracting copper concentrate in Saindak, Balochistan. However, final smelting is still done in China.

Barrick Gold is already engaged in developing Riqo Diq in Balochistan. This pit has rich deposits of gold and copper. It was recently agreed upon that the government of Pakistan will pay its share of investment in local currency. Production of gold and copper will take five years to materialize. The deposits are slated to last for a period of 40 years. Barrick Gold Corporation is investing $10 billion in the project. Profits will be equally shared by Pakistan and the Canadian company. Again the Pakistani share will be equally divided between the federal and provincial governments. Riqo Diq and Saindik are being described as game changers for the province of Balochistan and for Pakistan.

It is said that Pakistan’s northern areas have lithium deposits. This is the metal of the future as it is essentially used in electric car batteries. Similarly, copper is vital to electric transmission. Chromite is used to produce high quality steel. Although the GCC countries are rich in mineral resources, those are not exactly the same as the minerals to be produced in Pakistan. Therefore, a scope for a quid pro quo exists. For example, Pakistan could export its lithium to import phosphates from GCC countries. Phosphates are an essential ingredient of fertilizers. GCC countries have invested in corporate mechanized farming in Pakistan, which will go a long way in enhancing regional food security.

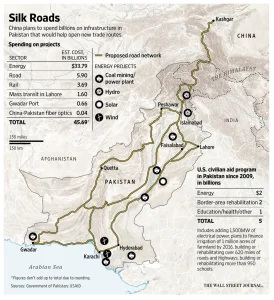

GCC investments in Pakistan’s mineral sector will be a win-win situation for both sides. Gulf countries have surplus capital while Pakistan is keen to improve its economic conditions and create employment facilities for its people. These objectives now appear achievable. Chinese trade with the Gulf Region has made impressive strides and is bound to increase further as the Pak-China Economic Corridor becomes operational, shortening the trade route. Pakistan will, that way, become an important facilitator of north south connectivity.

Geo-economics is gaining traction though it cannot replace geo-politics. The days of loans and financial grants are now receding. GCC investments in Pakistan’s mineral sector would, therefore, fit into this new scheme of things and inject new vitality to relations.

– Javed Hafeez is a former Pakistani diplomat with much experience of the Middle East. He writes weekly columns in Pakistani and Gulf newspapers and appears regularly on satellite TV channels as a defense and political analyst.